Chart of Accounts

Tailored Chart of Accounts for Construction Business

Created a customized Chart of Accounts in QBO for construction projects and job costing.

Developed a customized Chart of Accounts in QuickBooks Online for a construction company to track job costs, materials, labor, and subcontractor expenses accurately. Structured accounts to support project-based reporting, WIP tracking, and profitability analysis. The setup streamlined expense categorization, improved budget monitoring, and enhanced financial visibility, helping management make data-driven decisions and ensure accurate reporting for each project.

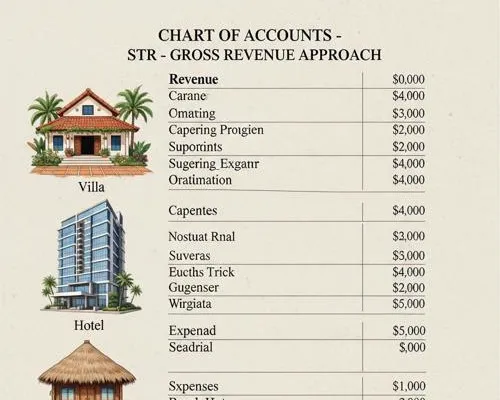

Tailored Chart of Accounts for STR Company - Gross Revenue Approach

Designed a customized chart of accounts aligning with the Gross Revenue approach for STR business.

Developed a customized Chart of Accounts for a rental management company following the Gross Revenue approach. Under this method, the full amount received from guests is recorded as revenue, and the payout to property owners is treated as a cost of sales. This structure provides a clear view of total earnings, owner expenses, and management profit, ensuring accurate financial reporting and better performance analysis for short-term rental operations.

Tailored Chart of Accounts for STR Company - Trust Accounting Approach

Designed chart of accounts using the Trust Accounting Approach to separate client and company funds.

Developed a tailored Chart of Accounts for a rental management company using the Net Revenue and Trust Accounting approach. In this method, guest receipts are recorded as liabilities since funds are held on behalf of property owners. Only the management commission or service fee is recognized as revenue. This ensures clear separation between company funds and client funds, supports transparency, and aligns with trust accounting standards for property managers handling owner money.

Tailored Chart of Accounts for Build & Flip Business

Created a customized Chart of Accounts in QBO for Build & Flip projects to track costs and sales.

Developed a customized Chart of Accounts in QuickBooks Online for Build & Flip real estate projects. The setup organized accounts to track land acquisition, construction materials, labor, subcontractors, and project-related expenses. It also included revenue and cost-of-goods-sold categories for each property, enabling accurate profit analysis and tax-ready reporting. The structure improved financial visibility, streamlined bookkeeping, and supported informed decision-making for each development project.

Tailored Chart of Accounts for Personal Budgeting and Expense Tracking

Designed a custom Chart of Accounts in QBO for personal budgeting and tracking.

Created a personalized Chart of Accounts in QuickBooks Online to organize personal income, expenses, and savings. Designed clear categories for salary, investments, household bills, and discretionary spending to support accurate budgeting and reporting. The setup helps track financial goals, monitor cash flow, and simplify year-end review while maintaining a clear overview of overall personal finances.

Products and services

Tailored Products & Services for Construction Businesses

Created a customized Products & Services list in QBO to track construction materials & labor.

Developed a tailored Products and Services list in QuickBooks Online for a construction company to accurately track materials, labor, subcontractors, and equipment costs. Each item was categorized for job costing and reporting, enabling precise expense allocation and profitability analysis by project. The setup improved invoice accuracy, streamlined cost management, and provided clear insights into project expenses, helping the business maintain better control over budgets and financial performance.

Tailored Products & Services for Plumbing Services

Created a customized Products & Services list in QuickBooks Online for plumbing materials & labor.

Developed a customized Products and Services list in QuickBooks Online for a plumbing business to accurately track materials, labor, and service charges. Each item was categorized to match job costing and invoicing needs, ensuring clear visibility of project expenses and profitability. The setup improved billing accuracy, streamlined service tracking, and provided detailed financial insights for better management and decision-making across plumbing projects.

Tailored Product & Services for STR Company- Gross Revenue Approach

Created tailored Products & Services list for STR company using Gross Revenue approach.

Developed a tailored list of Products & Services for a Short-Term Rental company using the Gross Revenue approach. Under this method, all guest payments are recorded as revenue, while owner payouts or commissions are treated as costs of sales. This structure ensures clear visibility of total income, expenses, and management profit, allowing accurate financial tracking and better reporting for property performance and business profitability.

Tailored Product & Services for STR Company- Trust Accounting Approach

Created tailored Products & Services list for STR company using Trust Accounting approach.

Developed a customized list of Products & Services for a Short-Term Rental company following the Trust Accounting approach. In this method, guest payments are recorded as liabilities since the funds are held on behalf of property owners, ensuring full separation of client and company money. Only management fees are recognized as revenue. This setup improves transparency, simplifies owner reporting, and ensures compliance with industry-standard trust accounting practices.

Financial Reporting

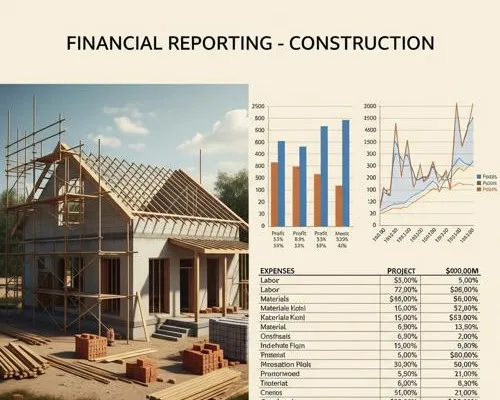

Customized Financial Reporting for Construction Business

Created custom financial reports for construction business to analyze performance and profitability.

Prepared customized financial reports for a construction business including Profit and Loss, Profit and Loss by Class, Profit and Loss by Month, Project Profitability, and AR/AP Aging reports. These reports provided comprehensive visibility into project revenues, expenses, and cash flow. Enabled accurate tracking of receivables, payables, and profitability across multiple projects, helping management make informed financial decisions and improve overall business performance.

Customized Financial Reporting for Short-Term Rental (STR) Business

Designed customized financial reports for STR business to track revenue, expenses & owner payouts.

Developed customized financial reports for a Short-Term Rental business, including Profit & Loss, Profit & Loss by Month, Profit & Loss by Customer, Balance Sheet, Owner Funds Reserved, and Owner Statements. These reports provide a clear view of income, expenses, and owner liabilities, supporting accurate tracking of financial performance. Designed to align with the chosen accounting approach—Gross or Trust—ensuring transparency and reliable reporting for property managers and owners.

Reconciliation

Bank Reconciliations

Performed accurate bank reconciliations to ensure transactions match QBO records.

Performed thorough bank reconciliations to ensure all transactions recorded in QuickBooks Online matched bank and credit card statements. Verified deposits, withdrawals, and adjustments for accuracy, identified discrepancies, and resolved them promptly. Ensured all accounts were balanced at month-end, improving the accuracy of financial reporting and supporting reliable decision-making through clean, up-to-date records.

Airbnb Earnings Reconciliation with QuickBooks Online

Logged into Airbnb to reconcile earnings reports with QuickBooks Online for transaction matching.

Performed Airbnb earnings reconciliation by logging into the host account and comparing Airbnb payout reports with transactions recorded in QuickBooks Online. Verified booking income, service fees, refunds, and adjustments to ensure all deposits matched bank entries. Identified missing or duplicate transactions and corrected discrepancies for accurate financial reporting. This process ensured complete alignment between Airbnb activity and QBO records, improving revenue accuracy and month-end reconciliation efficiency.

Quickbooks Integration

Airbnb Integration with QuickBooks Online via Tallybreeze

Integrated Airbnb with QuickBooks Online via Tallybreeze for automated rental income tracking.

Successfully integrated Airbnb with QuickBooks Online via Tallybreeze to automate income tracking and streamline bookkeeping for a short-term rental client. Set up property mapping, categorized Airbnb payouts, host fees, and refunds, and ensured all transactions synced accurately. Delivered clean reconciliations, P&L by Property, and real-time financial reports — reducing manual work and improving accuracy across all listings.

Buildertrend Integration with QuickBooks Online

Integrate Buildertrend with QuickBooks for accurate job costing, billing, and project financials.

Successfully completed Buildertrend and QuickBooks Online integration for a construction client. Set up cost codes, mapped accounts, and automated the syncing of vendor bills, invoices, and payments between both systems. Resolved sync errors and ensured accurate job costing, financial reporting, and real-time project visibility. Delivered a fully functional integration that improved accuracy, reduced manual entry, and streamlined project accounting processes.

Expense Management

Expense Management via Bill.com Spend & Expense Integration

Managed company expenses using Bill.com Spend & Expense integrated with QBO for accurate tracking.

Implemented and managed the Bill.com Spend & Expense solution integrated with QuickBooks Online to streamline expense tracking and approvals. Captured receipts, categorized expenses, and ensured accurate syncing with QBO for seamless reconciliation. Automated employee reimbursements and card expense entries, reducing manual errors and improving expense visibility, budget control, and overall financial accuracy for efficient month-end reporting.

Expense Management through Expensify Integration

Managed client expense reporting and approvals through Expensify integrated with QuickBooks Online.

Implemented and managed expense reporting using Expensify integrated with QuickBooks Online. Automated the capture and categorization of receipts, streamlined approval workflows, and ensured timely reimbursements. Maintained accuracy in expense records, reduced manual data entry, and improved visibility into spending. This setup enhanced efficiency in expense tracking and supported accurate financial reporting and reconciliation across all client accounts.