Bookkeeping

Unveiling the Power of Journal Entries

A journal entry is a formal and structured method of recording a financial transaction in the accounting system. Each entry follows a specific format designed to capture the dual impact of every transaction, adhering to the fundamental accounting principle of double-entry bookkeeping.

Understanding the Chart of Accounts (COA)

The Chart of Accounts (COA) is a systematic index of all financial accounts within a company's accounting system, serving as a foundation for organizing, recording, and analyzing financial transactions. It categorizes accounts into assets, liabilities, equity, revenue, and expenses, ensuring clarity and accuracy in financial reporting.

Expenses Recording and Categorization

Expenses Recording-Categorization refers to the process of documenting business expenses and organizing them into predefined categories. This practice helps track spending, manage budgets, and prepare accurate financial reports.

AI and Bookkeeping

AI and Bookkeeping refers to the use of artificial intelligence (AI) technologies to automate and enhance various bookkeeping tasks, improving efficiency, accuracy, and decision-making in financial management. AI tools can assist with data entry, transaction categorization, financial reporting, and compliance tasks, reducing the manual workload for accountants and bookkeepers.

QuickBooks Online

Setting up QuickBooks Online

Setting up QuickBooks Online involves creating an account, customizing company settings, connecting bank accounts, importing data, setting up chart of accounts, creating users, and customizing invoices.

Setting up Chart of Account in QuickBooks Online

Setting up the chart of accounts in QuickBooks Online involves creating, categorizing, and organizing accounts to track assets, liabilities, income, and expenses, ensuring accurate financial reporting and streamlined bookkeeping.

Customizing Preferences in the Company Profile on QuickBooks Online

Customizing preferences in QuickBooks Online involves updating company details, setting tax options, managing notification settings, adjusting invoice templates, defining payment terms, enabling integrations, and tailoring features to suit business needs.

Customizing Reports in QuickBooks Online

Customizing reports in QuickBooks Online involves selecting report types, adjusting date ranges, adding filters, modifying columns, and saving templates, enabling tailored financial insights to meet business needs and track performance.

Managing Bank Accounts on QuickBooks Online

Managing bank accounts in QuickBooks Online includes connecting accounts, importing transactions, reconciling balances, categorizing entries, tracking cash flow, automating updates, and generating reports for accurate financial management.

Managing Sales Invoices on QuickBooks Online

Managing sales invoices in QuickBooks Online includes creating professional invoices, customizing templates, tracking due payments, sending reminders, recording payments, and generating reports for efficient monitoring of sales and cash flow.

Managing Expenses on QuickBooks Online

Managing expenses in QuickBooks Online involves tracking purchases, categorizing expenses, uploading receipts, connecting bank accounts, setting budgets, managing vendor payments, and generating reports to monitor spending and ensure accurate records.

Managing Customers and Vendors in QuickBooks Online

Managing customers and vendors in QuickBooks Online involves creating detailed profiles, tracking transactions, recording payments, managing invoices and bills, setting credit terms, and generating reports for streamlined relationship and financial management.

Managing Products and Services in QuickBooks Online

Managing products and services in QuickBooks Online includes adding items, setting prices, tracking inventory, categorizing offerings, customizing descriptions, linking to accounts, and generating reports for accurate sales and stock management.

Setting up Payroll in QuickBooks Online

Setting up payroll in QuickBooks Online involves adding employee details, selecting pay schedules, setting up tax information, customizing deductions, configuring direct deposit, and automating calculations for accurate and compliant payroll processing.

Xero

Setting up a Xero Account

Step-by-step guide to setting up a Xero account for your business.

Setting up Chart of Accounts in Xero

Step-by-step guide to setting up the Chart of Accounts in Xero.

Customizing Preferences in your Company Profile in Xero

Step-by-step guide to customizing preferences in your company profile in Xero.

Customizing Reports in Xero

Step-by-step guide to customizing reports in Xero so you can make them fit your business needs.

Managing Bank Accounts in Xero

Step-by-step guide to managing bank accounts in Xero.

Managing Sales Invoices in Xero

Step-by-step guide to managing sales invoices in Xero.

Managing Expenses in Xero

Step-by-step guide to managing expenses in Xero (both business bills and employee expenses).

Managing Customers and Vendors in Xero

Step-by-step guide to managing customers (contacts) and vendors (suppliers) in Xero.

Managing Products and Services in Xero

Step-by-step guide to managing products and services in Xero (often called Inventory Items).

Setting up Payroll in Xero

Step-by-step guide to setting up Payroll in Xero (note: payroll features differ by country, but the flow is generally the same).

Odoo ERP

Basic Features of Odoo ERP System: Complete Guide for Businesses

Odoo ERP system is a flexible and affordable suite of integrated applications that simplifies business operations, and this guide will explore its basic features.

Setting Up Company Account in Odoo ERP System: Step-by-Step Guide

This guide details the step-by-step process and best practices for creating and configuring your company account in the Odoo ERP system to ensure smooth operations across all modules.

Setting Up Company Chart of Accounts in Odoo ERP System: Step-by-Step Guide

This guide provides the step-by-step process and best practices for correctly setting up your company account in the Odoo ERP system to ensure smooth operations across all modules.

Customizing Preferences in Company Profile in Odoo ERP System

This article explores how to set up and customize company profile preferences in the flexible Odoo ERP system to align the platform with business identity, financial regulations, and operational workflows, including advanced options for enhanced efficiency.

Customizing Financial Reports in Odoo ERP System

This article details the process and benefits of customizing financial reports in the Odoo ERP system to provide businesses with dynamic, tailored reports that support accuracy, compliance, and strategic insights.

Managing Bank Accounts in Odoo ERP System

This article explains how to manage bank accounts in the Odoo ERP system, covering setup, monitoring, reconciliation, and automation features for efficient financial operations.

Managing Sales Invoices in Odoo ERP System

This article explores the step-by-step process of managing sales invoices in the Odoo ERP system's comprehensive invoicing system, including its features for automation, payment tracking, and reporting.

Managing Expenses in Odoo ERP System

This article explores how to manage expenses in the Odoo ERP system's dedicated module, covering submission, approval, reimbursements, and reporting to simplify financial operations and ensure compliance.

Managing Customers and Vendors in Odoo ERP System

This article explores how the Odoo ERP system provides a unified platform to efficiently manage customers and vendors, strengthening relationships and optimizing financial workflows through streamlined record-keeping, invoicing, and reporting.

Managing Products and Services in Odoo ERP System

This guide explains how to manage products and services in the Odoo ERP system, utilizing its powerful tools for centralizing data, handling catalogs, pricing, and stock to ensure smooth operations and improved customer satisfaction.

Setting Up Payroll in Odoo ERP System

This guide explains the step-by-step process of setting up payroll in the Odoo ERP system's integrated module to automate salary management, reduce errors, and ensure legal compliance for smooth HR and finance operations.

Property Management

Specialized Account of a Rental Management Company

Specialized Accounts of a Rental Management Company involve accounting practices designed to handle property rentals, focusing on managing rental income, property expenses, and tenant-related transactions. These accounts ensure accurate financial reporting and efficient property management.

Chart of Accounts for Property Management Company

Chart of Accounts of a Property Management Company is a structured list of all financial accounts used to record business transactions in the hospitality industry. It is designed to manage the unique aspects of property accounting, including job costing, project management, and revenue recognition.

Terminology Used in Property Management Industry

Terminology Used in the Property Management Industry refer to specialized terms that describe key processes, roles, agreements, and financial aspects of managing rental properties. Understanding these terms is essential for effective communication among property managers, landlords, tenants, and service providers.

Role of Software and Tools in Property Management Industry

The Role of Software Tools in the Property Management Industry involves utilizing digital solutions to streamline various tasks such as lease management, tenant communication, financial tracking, and property maintenance. These tools enhance operational efficiency, reduce errors, and provide valuable insights for property managers and landlords.

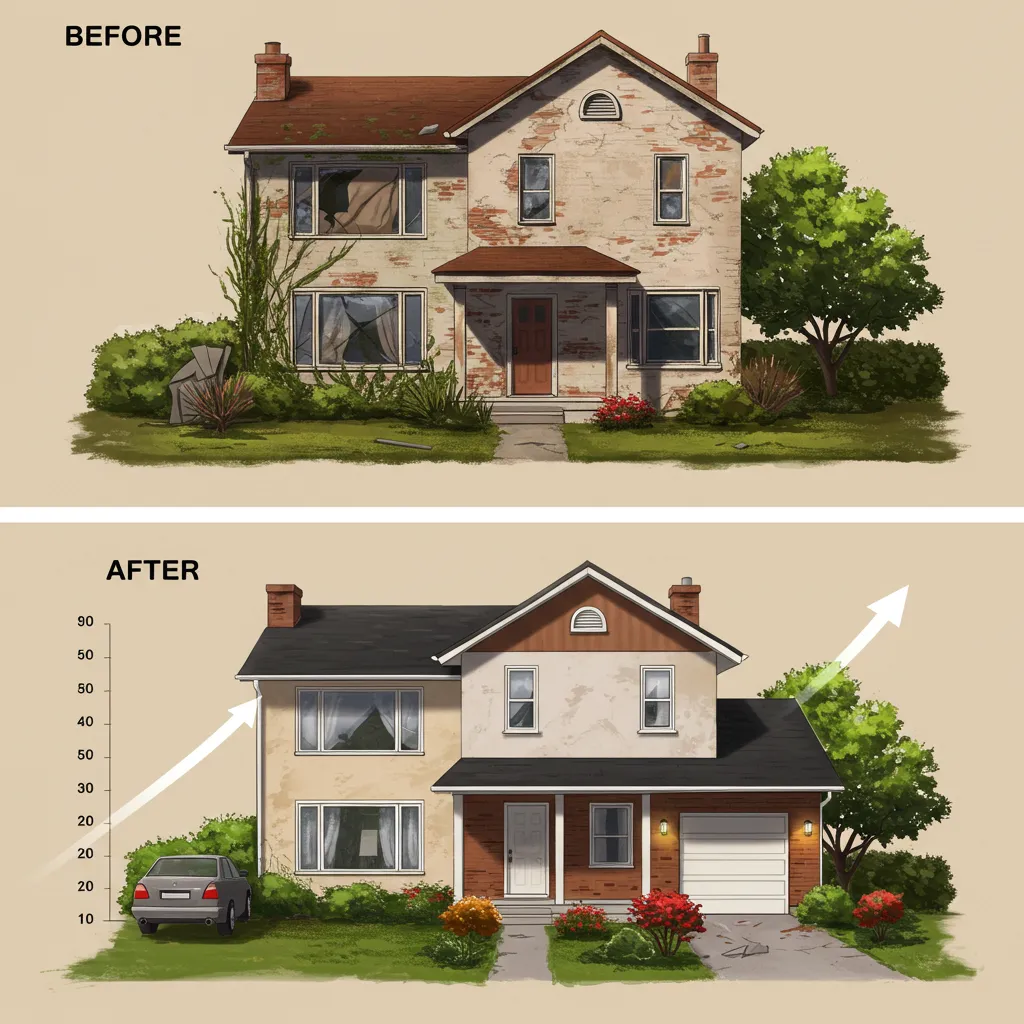

Real-Estate Flipping

Real estate flipping is the process of buying properties at a low price, renovating or improving them, and then reselling quickly at a higher price for profit.

Specialized Accounts, Chart of Accounts, and Tools for Real Estate Flipping

Real estate flipping, a fast-growing investment strategy, requires specialized accounts, a clear chart of accounts, and the right tools to manage the process of acquiring, renovating, and selling properties for profit.

AI and Short-Term Rental Management (STRM)

AI and Short-Term Rental Management (STRM) refers to the use of artificial intelligence (AI) technologies to streamline and enhance the operations of managing short-term rental properties, such as those listed on platforms like Airbnb, VRBO, and Booking.com. AI helps optimize pricing, improve guest experiences, manage bookings, and increase operational efficiency.

Construction

Specialized Accounts of Construction Industry

Specialized Accounts of the Construction Industry refer to unique accounting practices tailored to manage the complexities of construction projects. Unlike standard accounting, construction accounting addresses project-based work with variable costs, long timelines, and multiple contracts.

Chart of Accounts of a Construction Company

Chart of Accounts of a Construction Company is a structured list of all financial accounts used to record business transactions in the construction industry. It is designed to manage the unique aspects of construction accounting, including job costing, project management, and revenue recognition.

Guide to Key Construction Industry Terminologies

Construction Industry Terminologies refer to specialized terms and phrases commonly used in the construction sector to describe processes, materials, roles, and project management practices. Understanding these terms is essential for effective communication among professionals like contractors, architects, and project managers.

Role of Software and Tools in the Construction Industry

Role of Software Tools in the Construction Industry involves streamlining various aspects of construction projects through digital solutions. These tools enhance project planning, management, communication, and financial control, ensuring efficiency and reducing errors.

AI and Project Estimation for the Construction and Building Services Industry

AI and Project Estimation for the Construction and Building Services Industry refers to the application of artificial intelligence (AI) to enhance the accuracy, efficiency, and speed of estimating project costs in construction and building services. AI-powered tools analyze historical data, project parameters, and industry trends to produce more reliable estimates, reducing the risk of cost overruns and delays.

E-commerce

Management of an E-commerce Business

Management of an E-commerce Business involves overseeing all operations related to running an online retail platform, from product sourcing and inventory management to customer service and digital marketing. The goal is to ensure smooth operations, profitability, and customer satisfaction in a highly competitive online environment.

Specialized Accounts in E-commerce

Specialized Accounts in E-commerce refer to specific financial accounts and practices tailored to address the unique needs of online retail businesses. These accounts help track revenue, expenses, and transactions specific to e-commerce operations, ensuring accurate financial reporting and business management.